09.06.23

September 2023: Updates In California Background Investigation Procedures

HR Headliner

September 2023

Updates In California Background Investigation Procedures

In 2017, the California legislature passed the Fair Chance Act (Assembly Bill 1008), which prohibits employers from seeking information about a job applicant’s criminal conviction history until after a conditional job offer has been extended. Employers are permitted to revoke the offer if, after an individualized assessment, the applicant’s conviction history is found to have an adverse impact on the job in question.

In 2017, the California legislature passed the Fair Chance Act (Assembly Bill 1008), which prohibits employers from seeking information about a job applicant’s criminal conviction history until after a conditional job offer has been extended. Employers are permitted to revoke the offer if, after an individualized assessment, the applicant’s conviction history is found to have an adverse impact on the job in question.

In July 2023, the California Office of Administrative Law approved an amendment to the law, which adds greater detail to employers’ existing obligations. The basic steps of the hiring and background check process remain the same, but with a higher expectation for analysis and newly defined timelines for applicant notification. The changes become effective on October 1.

Pre-Offer Screening

The amended Fair Chance Act makes clear that employers are prohibited from inquiring into an applicant’s criminal history through application forms, background checks, or internet searches prior to making a conditional job offer. Employers also cannot attempt to pre-screen applicants by including qualifications in job announcements such as “Must have a clean record,” or “No felons.” Further, the amendments state that if an employer violates the prohibitions by asking about an applicant’s criminal conviction history prior to extending a job offer, the company may not use an applicant’s failure to disclose a conviction as a factor in any subsequent hiring decisions. This means, if you ask a candidate, “Do you think you’ll pass our background check?” and the applicant says he/she probably will, you cannot withhold a job offer just because the background check shows multiple charges that the applicant neglected to mention.

Initial Individualized Assessment

Current state law requires employers to analyze an applicant’s criminal conviction history to determine whether it justifies denying the applicant the position. We are instructed to consider the nature and gravity of the offense, the time that has passed since the offense occurred, and the nature of the job being sought. The amended law requires a reasoned, evidence-based determination and provides specific examples of factors to be considered. The California Civil Rights Department (CRD) provides a sample assessment form that may be used for this analysis.

Preliminary Notice and Applicant Response

Under current law, if an employer intends to revoke a job offer based solely or in part on the applicant’s criminal conviction history, we must notify the applicant of the preliminary decision and give him/her five business days to respond with additional information disputing the background check report or sharing information about rehabilitation or other mitigating circumstances. The amended law provides several specific examples of the evidence an applicant may provide and clarifies the minimum deadline for response as five business days from the receipt of notice. If notice has been sent through e-mail, it shall be deemed received two business days after it is sent. If notice is sent through postal mail, it is deemed received five calendar days after sending to California addresses, and ten calendar days after sending to non-California addresses. The CRD provides a sample Preliminary Decision Notice, available in both English and Spanish.

Reassessment and Final Decision

Employers are required to consider any information provided by the applicant before making a final decision regarding whether or not to revoke the job offer. While the legal requirements have not changed, the amended law provides examples of factors an employer may consider such as any community service, volunteer work, or educational efforts that may demonstrate rehabilitation and suitability for the job.

If the decision to revoke the offer remains final, the applicant must be notified in writing. The notice must include a statement that the applicant may contest the decision by filing a complaint with the Civil Rights Department. The CRD provides a sample Final Notice, available in both English and Spanish.

As always, Sierra HR Partners is here to help you navigate the ever-changing landscape of California regulations. Please contact us with any questions you have about your background investigation procedures and applicant notifications.

08.22.23

California’s Shifting Minimum Wage

HR Headliner

Recent History

California has had an especially dynamic minimum wage for several years. Senate Bill 3, passed in 2016, began a series of required annual increases at the start of each new calendar year. We have watched the minimum wage rate rise from $10.00 in 2016 to $15.00 per hour in 2022. Employers who adjusted payroll budgets every January looked forward to wage stability after that period of increases. Unfortunately, we have the opposite.

The same Senate Bill also added a provision to the Labor Code that requires the state Director of Finance to increase the minimum wage based on inflation. These increases must be determined “on or before August 1.” This is the provision behind the minimum wage increase to $15.50 for all employers effective January 1, 2023.

$16 Per Hour in 2024

Now, in a memo to Governor Newsom and other state leaders dated July 31, 2023, the state Director of Finance has announced that a similar minimum wage increase will be happening January 1, 2024. All employers, regardless of size, will be required to pay at least $16.00 per hour. This will not only impact those earning minimum wage, but also exempt employees who must earn at least twice the state minimum wage. Starting January 1, 2024, exempt employees must make at least $66,560 per year.

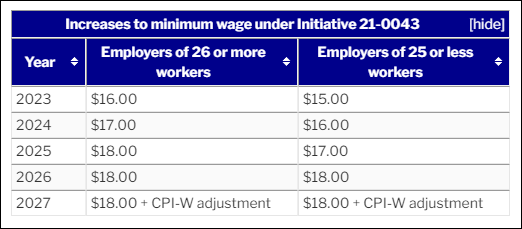

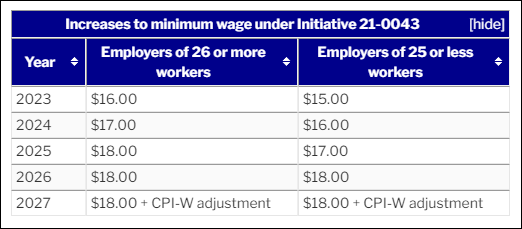

2024 Ballot Measure

While planning for the upcoming calendar year, employers should also take note of a 2024 ballot measure that proposes increasing the minimum wage to $18.00 per hour by 2026, with further hikes based on the Consumer Price Index.

Next Steps

For now, all employers should plan for the increase in minimum wage to $16.00 per hour and the associated changes (e.g., salaries for exempt employees and wages for employees required to use their own tools). We should expect additional announcements about the minimum wage for computer professionals later this year, and if you live in a municipality that has historically raised minimum wages above the state minimum (an early 2023 city ordinance in the city of Los Angeles raised the minimum wage there to $16.78 effective July 1, for example) we recommend keeping a close eye out for additional adjustments.

As always, Sierra HR Partners is here to help you navigate the ever-changing landscape of California regulations. Please contact one of our Consultants with any questions you have.

08.01.23

Revised I-9 Form

HR NEWS

The U.S. Citizenship and Immigration Services (USCIS) released the latest version of the I-9 Employment Eligibility Verification form earlier this morning.

The U.S. Citizenship and Immigration Services (USCIS) released the latest version of the I-9 Employment Eligibility Verification form earlier this morning.

To ensure compliance with the latest regulatory requirements, we encourage you to download the updated I-9 Form from the official USCIS website. This new version features several revisions and updates, so it is essential to utilize this latest edition for all new hires and any necessary re-verification.

Please note that employers must start using this new version of the Form I-9 for all employees hired on or after August 1, 2023. For existing employees with previously completed Form I-9s, there is no need to complete new forms unless re-verification is necessary due to expiring work authorization documents. We recommend switching to the revised form as soon as possible. Employers who continue to use the outdated form after October 31 could be subject to fines.

In addition to the revised form, USCIS published a final rule that allows for the remote examination of identification and employment authorization documents if employers participate in E-Verify. If you participate, or plan to participate, in E-Verify and would like the option to examine an employee’s documents remotely, contact Sierra HR Partners for more information.

We understand the significance of regulatory compliance and want to ensure that our valued clients remain up-to-date with the latest requirements. Should you have any questions or need assistance related to the I-9, our team is ready to provide support and guidance.

Overview of Form I-9 changes:

- Reduced Sections 1 and 2 to a single sheet. No previous fields were removed. Multiple fields were merged into fewer fields when possible, such as in the employer certification.

- Moved the Section 1 Preparer/Translator Certification area to a separate Supplement A that employers can use when necessary. This supplement provides three areas for current and future preparers and translators to complete as needed. Employers may attach additional supplements as needed.

- Moved Section 3 Reverification and Rehire to a standalone Supplement B that employers can use as needed for rehire or reverification. This supplement provides four areas for current and subsequent reverifications. Employers may attach additional supplements as needed.

- Removed use of “alien authorized to work” in Section 1 and replaced it with “noncitizen authorized to work” and clarified the difference between “noncitizen national” and “noncitizen authorized to work.”

- Ensured the form can be filled out on tablets and mobile devices by downloading onto the device and opening in the free Adobe Acrobat Reader app.

- Removed certain features to ensure the form can be downloaded easily. This also removes the requirement to enter N/A in certain fields.

- Improved guidance to the Lists of Acceptable Documents to include some acceptable receipts, guidance, and links to information on automatic extensions of employment authorization documentation.

- Added a checkbox for E-Verify employers to indicate when they have remotely examined Form I-9 documents.

Overview of Form I-9 Instructions changes:

- Reduced length from 15 pages to 8 pages.

- Added definitions of key actors in the Form I-9 process.

- Streamlined the steps each actor takes to complete their section of the form.

- Added instructions for the new checkbox to indicate when Form I-9 documents were remotely examined.

- Removed the abbreviations charts and relocated them to the M-274.

07.17.23

HR Headliner: July 2023

HR Headliner

Cal/OSHA Chief Jeff Killip: “Our team is out in full force, conducting targeted high heat inspections with a focus on construction, agriculture, landscaping, and warehouse industries to ensure employers are complying with the law.”

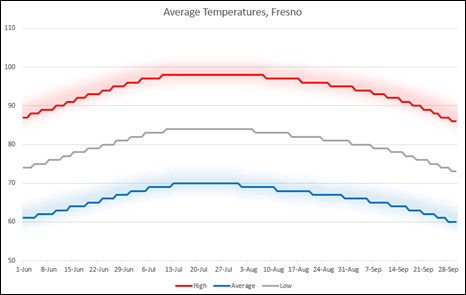

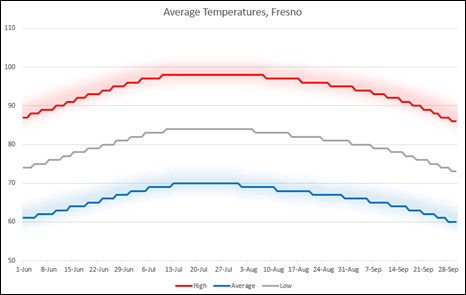

*Data from the National Weather Service.

With July’s arrival, we can look forward to months of hot weather in the Central Valley. The temperatures are up, and they aren’t falling any time soon.

If you have employees that work outdoors, you are subject to 8 CCR § 3395, Cal/OSHA’s outdoor heat illness prevention standard. This regulation requires employers to provide employees with water, shade, and rest.

It also requires employers to train employees and maintain a written heat illness prevention plan.

Water: Provide employees with water that is fresh, pure, suitable cool, and free of charge. This water should be located as close to employees as practicable. Encourage employees to drink water frequently – we may need up to two gallons per day.

Shade: Provide shade when temperatures exceed 80 degrees. There should be room for all employees.

Rest: Encourage employees to take cool-down rests as needed. They should rest for at least five minutes to protect themselves from overheating.

Even if you’ve lived in the Central Valley all your life, it takes our bodies time to adjust to working in high-heat conditions. During this period of acclimatization, employees must be closely observed for any signs of heat illness.

If your employees work indoors, you likely still have a responsibility to address high-heat conditions. While Cal/OSHA’s indoor heat illness prevention standard has not yet been approved, 8 CCR § 3203 – the same regulation that requires employers to maintain an Injury and Illness Prevention Program – also requires employers to assess and address workplace hazards. Cal/OSHA has already fined employers, under this regulation, for failing to address indoor heat.

We may even see an increase of this kind of enforcement, given federal OSHA’s National Emphasis Program from 2022 related to outdoor and indoor heat. In a news release from this week, Cal/OSHA Chief Jeff Killip said, “Our team is out in full force, conducting targeted high heat inspections with a focus on construction, agriculture, landscaping, and warehouse industries to ensure employers are complying with the law.”

It’s critical to think carefully about how you can protect your employees from heat illness. Contact Sierra HR Partners for help with your Heat Illness Prevention Program and heat illness prevention training.

07.17.23

🌟✨🏠 From Our House to Yours: Supporting Ronald McDonald House Charities! 🌟✨🏠

Uncategorized

We are absolutely thrilled to announce that Sierra HR Partners is joining hands with the incredible Ronald McDonald House Charities of the Central Valley (RMHCCV) in their extraordinary “From Our House to Yours” telethon!

At Sierra HR Partners, we firmly believe in the power of community and supporting those who need it most. That’s why we are incredibly proud to champion the inspiring mission of RMHCCV, which is to provide a loving and nurturing home away from home for the families of hospitalized children.

As parents, we understand the emotional and logistical challenges that arise when a child requires hospitalization. The Ronald McDonald House Charities of the Central Valley is a true beacon of hope, offering a sanctuary where families can find comfort, support, and essential resources during these difficult times.

Through our collaboration with RMHCCV, we aim to contribute to the incredible work they do, ensuring that families facing medical crises can focus on what truly matters: being together, supporting one another, and helping their children heal.

We invite all of you to join us in this remarkable endeavor! Your support can make a world of difference. Whether it’s spreading the word, donating, or volunteering your time, every act of kindness goes a long way in brightening the lives of these families and providing them with the care they need.

Let’s come together as a community and rally behind Ronald McDonald House Charities of the Central Valley. Together, we can create a lasting impact, bringing love, comfort, and a sense of home to those who need it most.

For more information about RMHCCV and how you can get involved, please visit their website at https://rmhccv.org/. Together, we can make a difference!

In 2017, the California legislature passed the Fair Chance Act (Assembly Bill 1008), which prohibits employers from seeking information about a job applicant’s criminal conviction history until after a conditional job offer has been extended. Employers are permitted to revoke the offer if, after an individualized assessment, the applicant’s conviction history is found to have an adverse impact on the job in question.

In 2017, the California legislature passed the Fair Chance Act (Assembly Bill 1008), which prohibits employers from seeking information about a job applicant’s criminal conviction history until after a conditional job offer has been extended. Employers are permitted to revoke the offer if, after an individualized assessment, the applicant’s conviction history is found to have an adverse impact on the job in question.

The U.S. Citizenship and Immigration Services (USCIS) released the latest version of the I-9 Employment Eligibility Verification form earlier this morning.

The U.S. Citizenship and Immigration Services (USCIS) released the latest version of the I-9 Employment Eligibility Verification form earlier this morning.