01.29.26

2026 HR Checklist: Steps to Start the New Year Right

HR Headliner

2026 HR Checklist: Steps to Start the New Year Right

Can you believe we’re in the year 2026?! If your business feels anything like ours, it’s already off and running in a big way. Each new year brings new legislation, updated documents, and changing regulations, so HR professionals should ensure that a few important basics are up to date and compliant.

2026 California Minimum Wage

Effective January 1, 2026, the state minimum wage was increased to $16.90 per hour. This also increases the minimum annual salary for an exempt employee to $70,304. Several cities and counties also increased their local minimum wages this year, and a full list is found here.

The minimum wage for fast food employees remains $20.00 per hour, but minimum wages for certain healthcare employees will increase effective June 1, 2026. We recommend checking with legal counsel if you are a healthcare facility and have questions about these requirements.

Provide the New Workplace Know Your Rights Notice by February 1st

California law requires employers to provide a variety of notices to employees, and a new notice deserves special attention. The Workplace Know Your Rights Act document must be given to all employees no later than February 1, 2026 and annually thereafter. This may be in print or via email, but state law requires employers to keep records of compliance (documentation of having provided the notice) for three years, including the date that each notice is provided or sent. Employers must also provide employees with an opportunity to designate an emergency contact who should be notified if the employee is arrested at the worksite.

This form may be downloaded inEnglish and Spanish.

Refresh Your New Hire Kit and Labor Law Posters

New employees must receive several state-required notices, which must also be posted in your workplace for employees’ reference throughout the year. These notices are often updated with new state or federal information, so we recommend refreshing your new hire packets and checklists annually. Earlier this month, Sierra HR provided links to all current new hire notices in English and Spanish.

One of the notices in your New Hire Kit, regardingleave and accommodations for survivors of qualifying acts of violence, must also be provided to all employees annually and upon request. We recommend sending this form along with the Workplace Know Your Rights document each year.

We suggest ordering your Labor Law posters from a trusted source such as theCal Chamber Store or the Labor Law Center. Don’t forget to fill in the information regarding pay days, workers’ compensation, and emergency phone numbers on your new posters!

2026 IRS Standard Rate for Mileage Reimbursement

Effective January 1, 2026, the IRS has increased its standard rate for mileage reimbursement to 72.5 cents per mile for most businesses. Travel in service of charitable organizations may be reimbursed at 14 cents per mile (no change from 2025.) Remember that employees must be reimbursed for expenses necessary for performing their jobs, which includes work-related travel in a personal vehicle (excluding their typical commute to and from work.)

Update Your Employee Handbook

If Sierra HR Partners has prepared your Employee Handbook, our Year In Review policy update program is underway. 2026 brings policy updates regarding bias mitigation training, wage ranges, leave and accommodations for victims of violence, and other topics. We are working hard to get all clients’ handbooks updated, and we appreciate your patience with the process! If you have a specific deadline in mind for distributing the new handbook to your team, or if you have any other questions, please let us know.

If Sierra HR has not prepared your Employee Handbook, this may be a great time for an audit to ensure that your policies are up-to-date with California law and your current company practices. Please contact one of our certified Consultants for more details!

As always, contact one of our certified Consultants if you have questions about any of these topics. We’re here to help!

Consultants@sierrahr.com

559-431-8090

09.04.25

Real Talk, Real Growth: The Case for Honest Feedback

HR Headliner

Real Talk, Real Growth: The Case for Honest Feedback

September 2025

At Sierra HR, we often hear from managers who are frustrated with an employee’s unreliable attendance, or subpar performance, or lack of initiative and motivation. “What should we do?” the manager asks. Our typical follow-up: “What have you done so far? Have you talked with this employee about the problem? What was their response?” And that’s where things tend to go downhill.

For a wide variety of reasons, managers are often apprehensive about taking corrective action. Some managers think that having a “negative” conversation will put a damper on the employee’s morale (“We really don’t want to bum her out.”) Or maybe the employee is dealing with personal problems, and the manager doesn’t want to seem uncaring (“I heard he’s going through a lot at home…”) If feedback is given to an employee at all, it’s often a watered-down or sugar-coated version of the intended message.

But unclear feedback isn’t kind or compassionate. It’s confusing, and can actually prevent the employee from being successful in the job and growing with the company. Sugar-coated feedback allows the employee to continue down a path toward frustration (on both sides), a lack of job satisfaction, and possible termination. As managers, it’s our job to be both kind and clear. We should give direct, actionable information in a way that shows support and preserves the relationship. Consider these examples the next time you’re hesitant to have a tough conversation:

Instead of: “You’re doing great, just a few little things to tweak.”

Say this: “You’ve made strong progress. Let’s look at your job description and talk about two specific areas that still need work.”

_ _ _ _ _

Instead of: “Maybe try to be a bit more proactive?”

Say this: “Moving forward, I need you to take initiative in [specific area], especially when it relates to [cite applicable company values or priorities].

_ _ _ _ _

Instead of: “Just something to keep in mind for next time…”

Say this: “This is a key area of development for your role. Let’s agree on a plan to improve it.”

_ _ _ _ _

Instead of: “Sorry, I just wanted to mention real quick…”

Say this: “I want to bring this to your attention because it’s important for your growth and success in this job.”

Feedback that is clear, direct, and growth-focused shows respect for your employee and gives him/her the best shot at success. It also supports the company’s mission, values, and goals. Good managers can offer compassion and support while also standing firm on the performance expectations of the position. This balance is what leadership is all about.

07.02.25

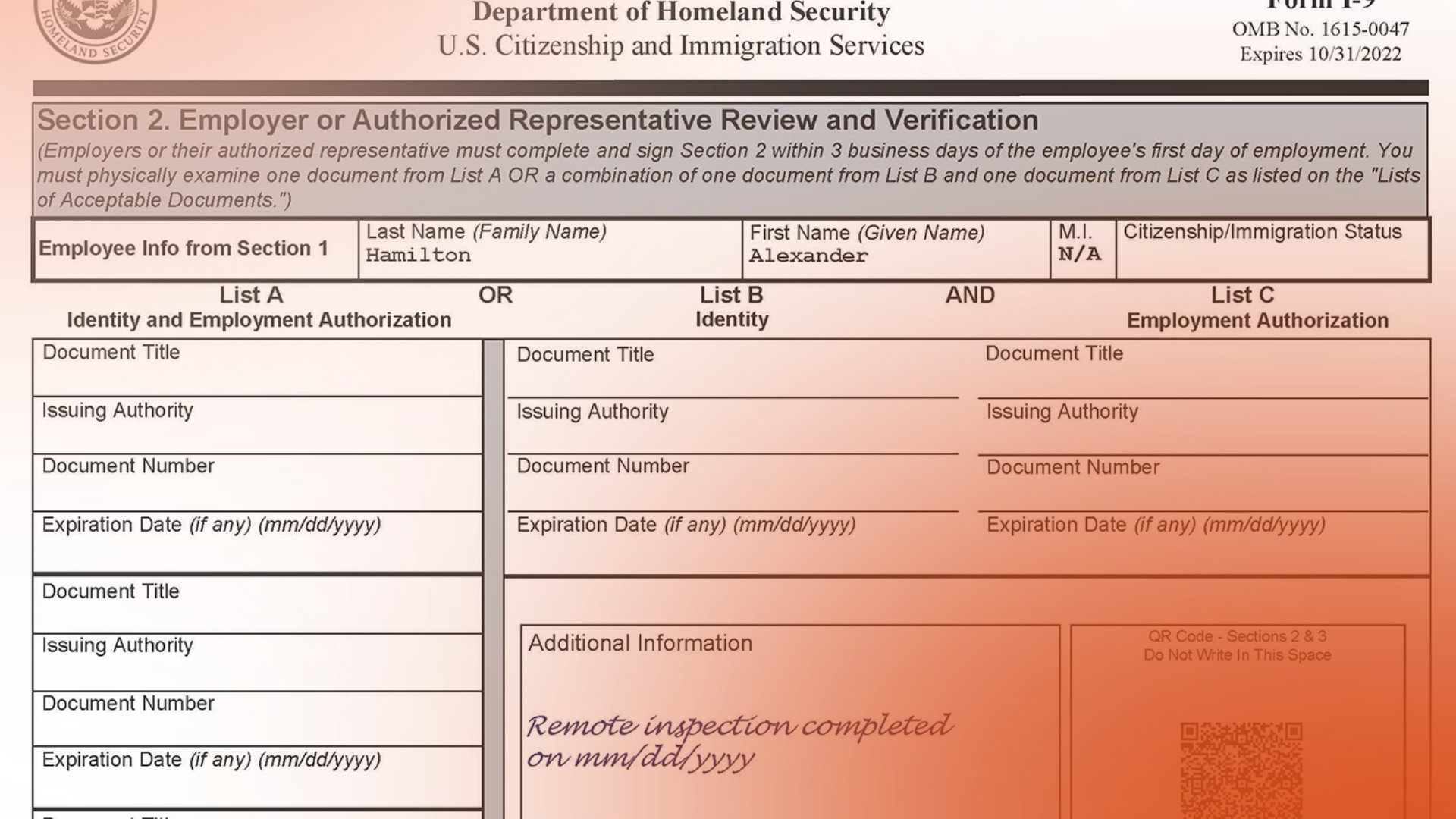

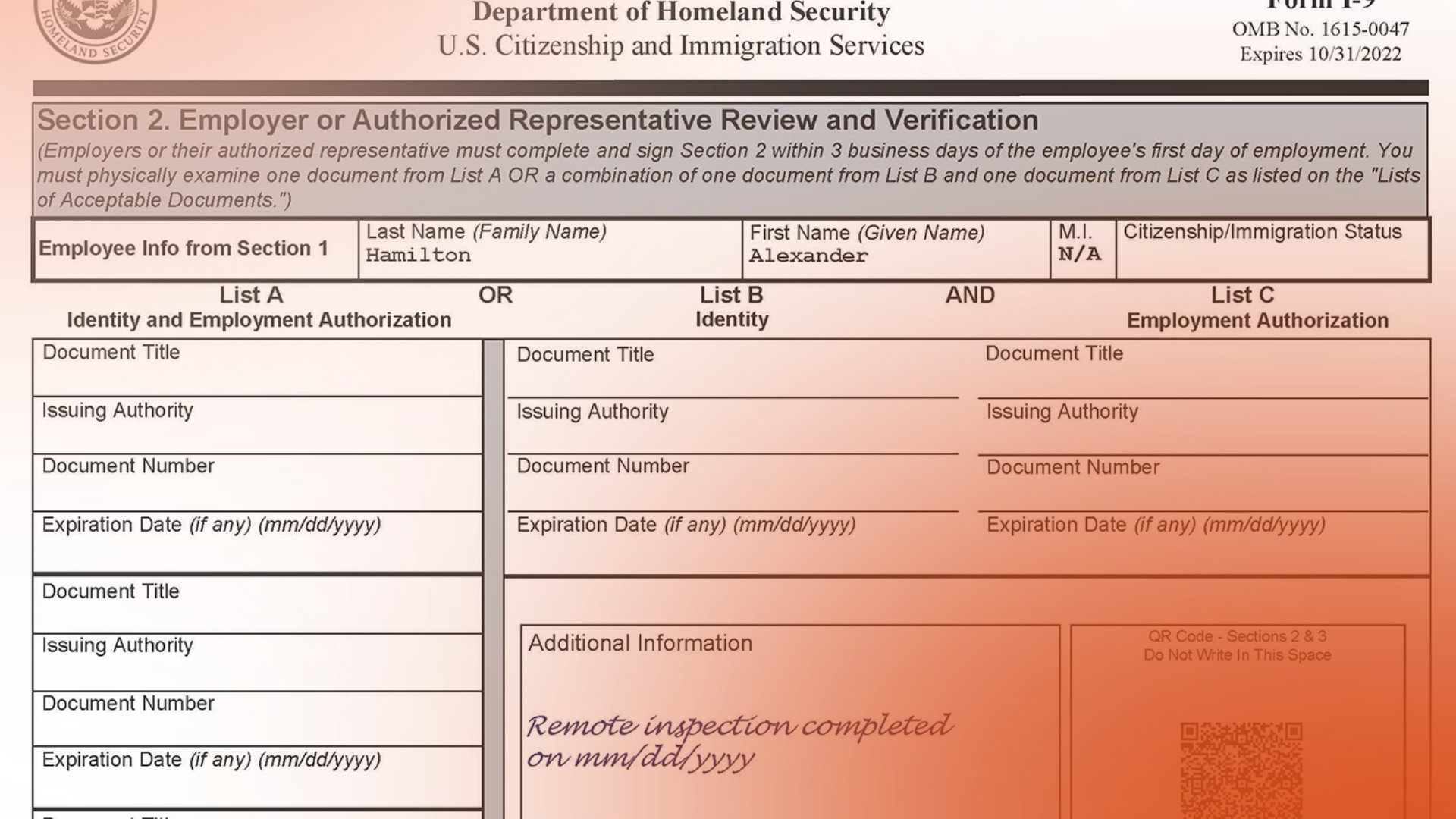

Form I-9 Reviews

HR NEWS

Form I-9 Reviews

On Tuesday, June 10, the U.S. Immigration and Customs Enforcement agency (ICE) conducted the largest worksite enforcement operation in Nebraska so far this year, detaining 76 people from Glenn Valley Foods in Omaha. In a press release about the operation, ICE suggested more such operations, stating that:

“Worksite enforcement remains a priority for ICE as it seeks to protect the nation’s workforce, eradicate labor trafficking and hold employers accountable for practices that encourage illegal immigration. Employers found in violation of federal hiring laws may face civil penalties and, in some cases, criminal prosecution.”

In southern California, protests that turned into riots over immigration enforcement have led to clashes between local police and federal agents. President Trump’s deployment of the California National Guard was initially blocked by a federal judge, but that order was temporarily overruled by the 9th Circuit Court of Appeals.

State tensions and stories of imminent worksite enforcement operations – Glenn Valley Foods had never seen such an operation before – have left many employers skittish and eager to ensure their compliance with federal I-9 requirements. Yet employers should be careful; mishandling I-9 audits or corrections can lead to legal risk.

Remember these tips:

– I-9 Form expiration dates don’t “expire” a completed form. The “expiration date” at the top of an I-9 form applies to when the form should be replaced with a more current version. It does not signal a requirement for employers complete a new I-9 form for current employees.

– “List B” documents that verify an employee’s identity never need to be reverified. As long as a List B document was unexpired at the time of hire, it does not ever need to be reverified.

– Making corrections is not always simple, and unconfident employers should not do it alone. Sometimes I-9 corrections are as simple as adding in missing information. Often, making corrections is not a simple matter. The I-9 Handbook for Employers can be a helpful resource, as can Sierra HR or your attorney.

You don’t need to audit or correct I-9 forms on your own! Sierra HR Partners can assist you in making compliant corrections where needed, while minimizing legal risk with employees who have already verified their identity and employment eligibility. We can also train your administrative employees on how to complete and audit forms as employees are hired. Join us from 9 am – 10 am on July 10th for a detailed training workshop on the steps for completing Form I-9, inspecting employees’ documents, and properly re-verifying information. Click here to register.

06.09.25

HR Headliner June 2025: Don’t Let ChatGPT Drive You Off a Cliff

HR Bulletin

Don’t Let ChatGPT Drive You Off a Cliff

AI is a great tool… trust but verify!

In May 2018, an Oregon truck driver was missing for four days and had to walk 36 miles through the snow when his truck got stuck after his GPS mapping device sent him up the wrong road. In July 2024, a Utah man was stranded on a mountain for three hours after following a Google-suggested shortcut. And in January 2025, a Colorado man’s car got stuck at the bottom of a ski trail after following Siri’s driving instructions “to a tee.”

What do these unfortunate adventures have to do with our work in HR? They’re examples of how trusting the internet, and especially AI tools like ChatGPT, without using critical thinking skills can steer us far off track!

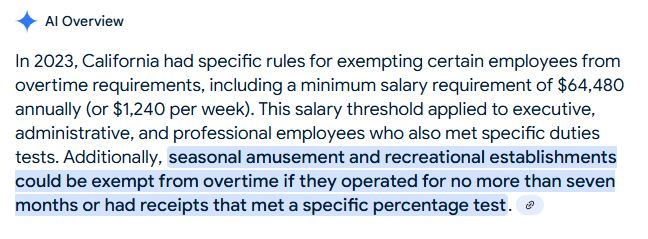

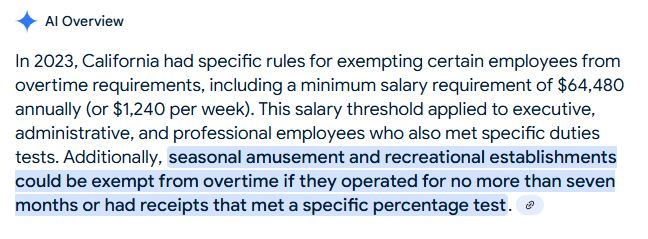

It’s becoming more and more common to use AI for a wide variety of HR tasks. We can write policies and job descriptions, generate training agendas, research compliance questions… the list goes on. These tools can be extremely helpful, but they shouldn’t be copied and pasted into formal company documents or used to make a complex employment decision without double checking the message. California employment law questions should get special review, because we know our state’s requirements are often different from federal law. The “AI Overview” at the top of your Google search often blends multiple online sources or adds a dash of federal law, creating confusion and potentially pointing you in the wrong direction. For example, a search for information about paying overtime to seasonal employees for a recreational program seems to indicate that short-term operations could be exempt. This is a federal rule, but there is no such exemption in California.

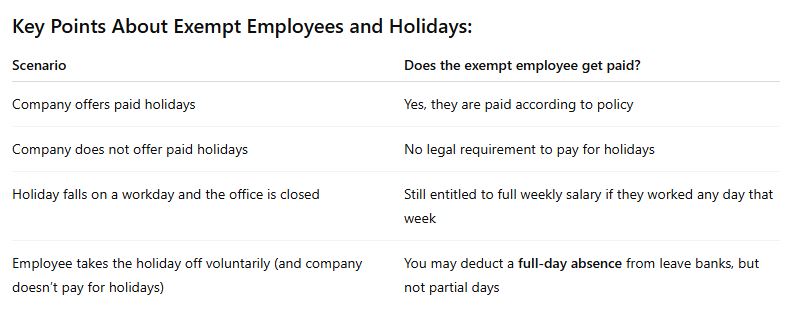

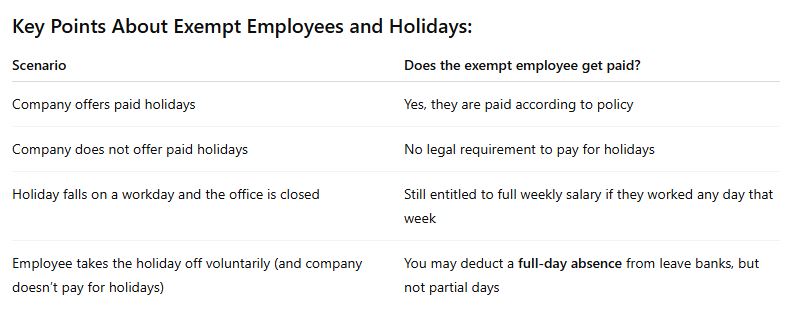

We asked ChatGPT if exempt employees are entitled to paid holidays, and the response seems clear at first, but could actually lead to confusion. Based on the table below, if the company does not offer paid holiday benefits, does the exempt employee receive pay for a holiday…or not? Further, this states that leave banks such as vacation can only be deducted in full-day increments, which is inaccurate.

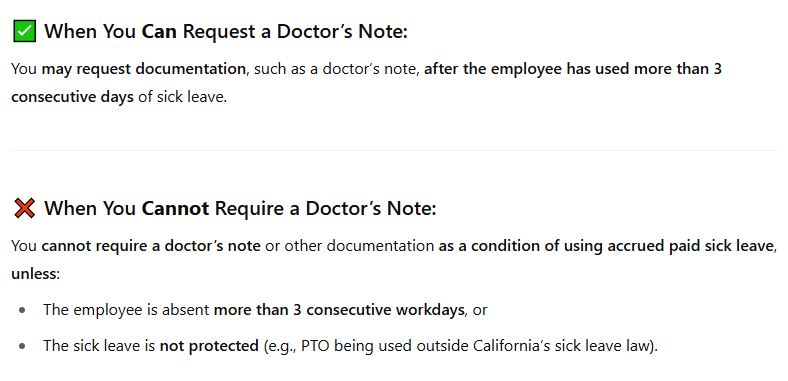

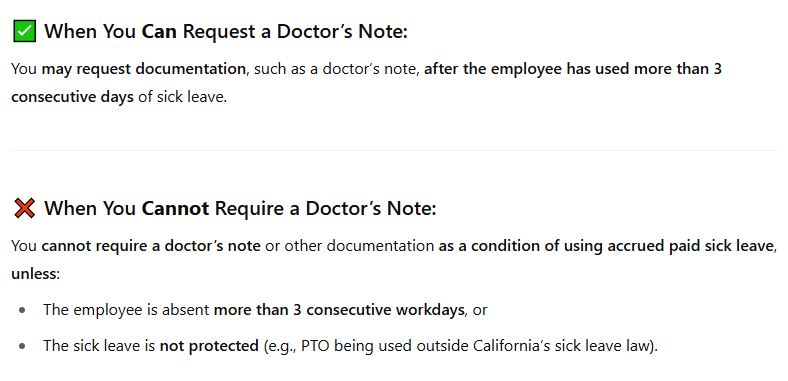

Next, we asked ChatGPT if an employer could require a doctor’s note as a condition of approving paid sick leave. The AI recognized California’s protections regarding the use of state-mandated PSL, but uses a 3-day time threshold, which is not part of our current law. Employees are entitled to use up to five days or 40 hours of PSL per year, and we cannot require medical certification as a condition of using any available sick time.

In some cases, the AI information may simply be outdated, as shown by this response to a search about paycheck deductions. Effective January 1, 2025, California’s minimum wage is $16.50 per hour, but the AI Overview still cites $16.00.

A 2023 HR Morning article describes the risks well: “While the AI could handle linear, straightforward questions, its answers became unreliable as questions got more complex. In almost all cases, the answers ChatGPT provided were missing necessary nuanced details and in some cases ChatGPT completely fabricated reference material that did not exist at all.”

We’re not suggesting that HR professionals avoid using AI tools! There can be many helpful benefits of this growing technology. But it’s important to remember that ChatGPT is not a replacement for your own critical thinking. As this Harvard Business Impact article describes, a rushed project or decision (especially one using flawed online guidance) rarely leads to the best result. Slow down, look for possible errors or confusion, and consider whether the information really applies to your business.

And, remember that the Consultants at Sierra HR are available to really listen to the nuances and details of your HR issues and provide legally-compliant resources and individual guidance. We promise to never leave you stranded!

04.03.25

HR Headliner: What Have You Done For Me Lately? Communicating Your Total Rewards Program to Employees

HR Headliner

April 2025 HR Headliner:

What Have You Done For Me Lately?

Communicating Your Total Rewards Program to Employees

Business owners know that a competitive compensation package is essential for attracting and retaining great employees. Your “total rewards” program includes monetary factors such as wages, bonuses, paid time off, and insurance coverage, and non-monetary benefits such as employee recognition programs, flexible scheduling options, and career training and enrichment opportunities. With so much time and energy dedicated to developing these areas, do you ever feel that employees don’t fully appreciate what the company has to offer? Below are a few tips for effectively communicating your total rewards philosophy:

Start by being a good listener. Seek employees’ feedback about what kinds of compensation and benefits are most meaningful to them. Not only will this allow you to focus your budget on the best programs, it will help employees feel “in on things” and that their opinions matter to the company.

Connect your compensation package to the company’s mission and goals. For example, a company in a growth phase might emphasize client acquisition bonuses or job upskilling activities. A firm that values its community roots could highlight employee volunteering or sponsorship opportunities.

Provide clear, detailed information about each component of your total rewards program. Of course employees see the paychecks they receive, but do they understand all that their health insurance plan has to offer? Do they know about available training courses that may make them eligible for promotion? Do they know about an Employee Assistance Program that offers mental health support and financial planning assistance?

Use multiple communication channels. A beautifully-designed company newsletter may not be effective for employees who don’t sit at a desk or have time to check company emails during the day. Posted notices or printed memos delivered by supervisors can help to ensure everyone receives the right information. Be mindful of language differences, as well.

Address employees’ questions and concerns in a timely manner. If an employee is frustrated with your health insurance carrier or believes that new hires with less experience are receiving higher wages, it’s best to offer support and clarity before minor issues grow into larger grievances.

Provide comparisons and benchmarking information when needed. Employees may have inaccurate perceptions of what other companies provide. When appropriate, sharing salary surveys and other research can help to show that your business is staying competitive.

Sierra HR Partners is here to help you analyze your total rewards programs and communicate effectively with employees. Contact one of our certified Consultants with any questions you have!