02.12.25

HR Headliner: Employers Urged to Prepare for Surge in I-9 Audits Amid Changing Immigration Policies

HR Headliner

Employers Urged to Prepare for Surge in I-9 Audits Amid Changing Immigration Policies

As new regulations take effect, businesses face the risk of costly penalties for I-9 compliance failures; experts advise proactive audits and training to avoid issues.

The new presidential administration has already made significant changes to how the Federal government approaches immigration policy. Experts suggest that employers should be prepared for a surge in I-9 audits. During the first Trump administration, audits rose from over 1,300 in 2017 to almost 6,000 in 2018 and almost 6,500 in 2019. (The COVID-19 pandemic halted a planned 15,000 audits in 2020).

The new presidential administration has already made significant changes to how the Federal government approaches immigration policy. Experts suggest that employers should be prepared for a surge in I-9 audits. During the first Trump administration, audits rose from over 1,300 in 2017 to almost 6,000 in 2018 and almost 6,500 in 2019. (The COVID-19 pandemic halted a planned 15,000 audits in 2020).

Employers are required by Federal law to complete Form I-9 for each new hire. New employees must provide documents that verify their identity and their work authorization, and employers must examine these documents to confirm their validity. Form I-9 documents this process. Employers who fail to follow these requirements or who complete Form I-9 incorrectly could be subject to civil fines, and employers who employ individuals not authorized to work in the United States may also be subject to criminal penalties.

While some industries, including agriculture, manufacturing, and construction, are more likely to be targets of I-9 audits, any employer could be subjected to an audit. If I-9 forms are missing, incomplete, or were completed late, if document information was transcribed incorrectly, or if forms have not been retained as required, employers could be subject to penalties totaling in the tens or even hundreds of thousands of dollars. Employers should review their new hire orientation process to ensure that I-9 forms are completed correctly, and previously completed I-9 forms are audited and (as needed) corrected. Every employer should now be using the recently updated Form I-9 with an expiration date of 05/31/2027.

USCIS has published guidance on internal audits for employers. Sierra HR Partners can also assist with internal audits and training administrative staff on completing I-9 forms accurately and making corrections appropriately. Once a Notice of Inspection has been received from ICE, employers typically have three days to provide requested forms; it is best to make corrections to forms before such notices are received.

Don’t forget – employers must post their 2024 annual summary of work-related injuries and illnesses (Form 300A) starting February 1. This summary must be left posted through April 30, even if no injuries occurred in 2024. Instructions and a blank copy of Form 300A can be found here from the DIR

01.09.25

HR Wisdom From Hollywood Drama

HR Headliner

HR Wisdom From Hollywood Drama

What Managers Can Learn from the Blake Lively/Justin Baldoni Legal Case

The entertainment world does not often intersect with HR, but late last month it did just that, in a complaint filed by Hollywood star, Blake Lively, against former director and co-star, Justin Baldoni. The two had starred in the August release It Ends with Us, and Lively had strangely been subjected to disparaging stories at the time. Lively’s complaint against Baldoni included many damning text messages – but how exactly did those end up in the hands of Blake Lively’s legal team? The answer is Stephanie Jones, founder and CEO of celebrity PR firm, Jonesworks.

The Backstory: Jonesworks had been providing services to Justin Baldoni since 2017, with a Jonesworks publicist named Jen Abel eventually assuming responsibility for the Baldoni account. Ms. Abel was responsible for this account during the events that gave rise to Lively’s complaint. For some reason, in July 2024, Ms. Abel submitted her resignation – “With LOVE!” – with a commitment to remain until August 23.

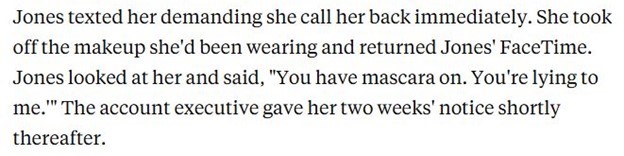

The Drama Starts to Brew: That final month was hardly uneventful. On August 15, Business Insider published a hit piece on Jonesworks CEO Stephanie Jones, accusing her of being “combative” and “tyrannical.” As an example, the piece included a story of Ms. Jones calling an employee on FaceTime to check on her after she took a sick day (the horror!). The employee had admittedly taken the sick day to attend a job interview and was forced to hurriedly wipe off the makeup she’d been wearing, but she couldn’t hide her mascara.

Ms. Jones suspected Ms. Abel was involved in the piece and fired her on August 21, two days before her planned final day of work. The (likely) surprise termination meant that Ms. Abel didn’t have time to delete personal data from her company-provided cellphone, and when Ms. Jones examined the phone, she confirmed that Ms. Abel had indeed been in contact with Business Insider. The phone also contained the text messages later used in Lively’s complaint against Baldoni.

The intricacies of how Blake Lively became the recipient of these messages includes some speculation beyond the HR implications of this case, and we are not weighing in on the validity of her claims. Yet, it’s worth noting that Jonesworks is not included as a defendant in her complaint, while Jen Abel’s new PR firm, set up in the wake of her termination (and taking several Jonesworks employees and clients, including Baldoni), is. Perhaps it’s best not to conspire against your employer using a searchable company-owned device.

The HR Lesson: At Sierra HR, we are often asked about how to approach employee resignations. Sometimes, resignations mark the end of a legitimately positive relationship (and not just a superficially positive one, like between Ms. Jones and Ms. Abel). In those cases, immediate action is usually unnecessary. But what about mediocre or toxic employees? Are we bound to honor their resignations?

The answer, of course, is no – we are not obligated to honor an employee’s timeline. In fact, doing so may give toxic employees a chance to further damage morale or steal/destroy company assets or information, leaving us to clean up the mess long after they’re gone. An employer may be worried about the former employee being awarded Unemployment Insurance, and it’s true that terminating employment early would change a “resignation” into an “involuntary termination,” but an Unemployment claim is not a compelling reason to hold onto an otherwise destructive employee.

We should also not provide employees with the opportunity to wipe data from company devices. As our Employee Handbook policy states, “all information placed on computers, telephones or any electronic data system, whether or not personal in nature, is property of the company and may be assessed and reviewed by the company, without notice or reason.” And, as with Stephanie Jones, you may have very good reason to “assess and review” what employees have been doing with their company phone or other device. It is a mistake to allow them to reset company devices on their way out the door.

If you would like support in planning or conducting sensitive terminations, don’t hesitate to call Sierra HR Partners (559-431-8090). These unpleasant events may be unavoidable, but a timely and efficient process can help to avoid costly employee behaviors.

Written by Senior HR Consultant, Dan Larsen, PHR

12.20.24

Minimum Wage Increases for 2025

FLC - Wage & Hour

Minimum Wage Increases for 2025

As the new year approaches, we want to remind you of the changes in the minimum wage rates.

Statewide Minimum Wage. On January 1, 2025, the state minimum wage rate will increase from $16.00 to $16.50 per hour. There are 39 cities and one county in California that impose higher minimum wages. Contact Fishman, Larsen & Callister or Sierra HR Partners if you have questions about the minimum wage in your municipality.

Minimum Salary for Exempt Employees. Don’t forget that the increase in the state minimum wage will also increase the minimum salary for employees who are exempt as “white collar” employees. To continue the exemption into 2025, employers must pay managers, professionals and administrators two times the minimum wage or $68,640.

Fast Food Minimum Wage. Fast food workers will continue to earn $20.00 per hour. However, this wage may increase later in the year.

Health Care Worker Minimum Wage. The healthcare worker minimum wage went into effect on October 16, 2024. It will not increase until July 1, 2025.

Computer Software Employee Minimum Wage. Computer software employees may be exempt from overtime if they are paid a minimum wage. In 2025 the minimum hourly rate of pay is $56.97. The minimum monthly salary level is $9,646.96. The minimum annual salary exemption level is $118,657.43.

Physicians and Surgeons. Physicians and surgeons paid an hourly rate may be exempt from overtime if they are paid a minimum hourly wage. In 2025 the minimum hourly rate of pay is $103.75.

Minimum wages and exemptions have become much more complex. The failure to pay the appropriate wages or failure to meet the requirements for the exemptions can result in significant liability for unpaid wages and civil penalties. Please reach out to Fishman, Larsen & Callister or Sierra HR Partners if you have questions about minimum wages or whether an employee is exempt from overtime compensation.

Fishman, Larsen & Callister

Doug Larsen: larsen@flclaw.net

Mike Green: green@flclaw.net

559.256.5000

Sierra HR Partners

Brenda Budke: budke@sierrahr.com

Janet Keene: keene@sierrahr.com

Daniel Larsen: larsen@sierrahr.com

559.431.8090

12.11.24

Labor Law Updates for 2025

HR Headliner

It’s hard to believe that 2025 is just around the corner! The year ahead will bring a variety of changes to California employment laws, impacting your HR policies and company procedures. We know it’s challenging to keep up with all of the new requirements while staying focused on your business, and Sierra HR is here to help! Below is a summary of key legislative changes and action steps you can take to ensure your company remains compliant and well-prepared.

It’s hard to believe that 2025 is just around the corner! The year ahead will bring a variety of changes to California employment laws, impacting your HR policies and company procedures. We know it’s challenging to keep up with all of the new requirements while staying focused on your business, and Sierra HR is here to help! Below is a summary of key legislative changes and action steps you can take to ensure your company remains compliant and well-prepared.

California Minimum Wage: Effective January 1, 2025, our statewide minimum wage will increase to $16.50 per hour. This means the new minimum salary for an exempt employee must be at least $68,640 per year. (Employers in the healthcare industry or cities/counties with minimum wage ordinances may have higher requirements.)

Action Step: Review all employees’ wage rates to ensure compliance. If any exempt employees’ salaries will no longer meet the minimum requirement, consider either increasing the salary or transitioning the employee to non-exempt (hourly) status.

Senate Bill 1100 – Driver’s License Discrimination: This law prohibits employers from requiring an employee to have a driver’s license as a job qualification, unless the job duties will include driving. The employer must also be able to show that allowing those duties to be done through other means of transportation, such as riding a bicycle or using a ride share service, would not be comparable in travel time or cost to the employer.

Action Step: Review your job descriptions and job announcements to identify any positions that include a driver’s license as a required qualification. Consider whether driving is actually a necessary part of each position, and make appropriate edits. Sierra HR Partners is available to help you analyze job requirements, if desired.

Assembly Bill 2123 – Required Use of Vacation Benefits Before Paid Family Leave: Current law allows employers to require the use of up to two weeks’ vacation/PTO before an employee may claim Paid Family Leave benefits through the EDD. Effective January 1, 2025, this law will prohibit employers from making this requirement. Employees may elect to use accrued vacation/PTO to coordinate with PFL payments received from the state during a leave of absence.

Action Step: Review your Employee Handbook policies and Leave of Absence notices to ensure compliance. Be sure to share this change with supervisors to ensure consistency in employee communications.

Assembly Bill 2499 – Protections for Victims of Crime: Existing state law provides leave entitlements and on-the-job protections for employees who are victims of domestic violence and other specified crimes. The new law expands eligibility to include employees who are victims of “qualifying acts of violence” and adds protections for employees whose family members are crime victims. There will also be a new posting requirement, with a form available from the Civil Rights Department by July 1, 2025.

Action Step: Review your Employee Handbook policies and company procedures regarding leaves and protections for victims of crime to ensure compliance. Train supervisors to recognize employee cues of the need for leave or accommodations, and engage in an interactive process with employees who may need support.

Senate Bill 1137: Discrimination Claims, Combination of Characteristics: This law adopts the concept of “intersectionality” as an analytical framework which claims that different forms of inequality operate together, exacerbate each other, and can result in amplified forms of prejudice and harm. The Unruh Civil Rights Act and the Fair Employment and Housing Act prohibit discrimination based upon the combination of any two or more protected bases.

Action Step: Continue to maintain a workplace that is characterized by professionalism and respect, and train supervisors and employees to avoid conduct that is, or could be perceived to be, hostile or discriminatory on the basis of any protected characteristic, of combination of them.

Senate Bill 399 – Worker Freedom from Employer Intimidation: This law prohibits employers from taking adverse action against employees who decline to attend mandatory meetings or read employer communications on religious or political matters. An employee who is working at the time of a meeting but elects not to attend must be paid for his/her entire schedule.

Action Step: We feel like this should go without saying, but don’t conduct mandatory employee meetings on political or religious topics. If a related subject is particularly important to the company and an employee meeting is deemed beneficial, be sure employees understand that attendance is voluntary and avoid retaliatory actions against any employee who chooses not to attend.

10.03.24

UPDATE: Healthcare Minimum Wage Increase Effective October 16, 2024

HR Headliner

On October 1, we let you know that California’s increasing minimum wage for healthcare workers was likely to become effective in the near future… and we didn’t have to wait long for the announcement to be made.

Later that day, the California Department of Health Care Services notified the Joint Legislative Budget Committee that it had initiated the process of data retrieval relating to hospital quality assurance fees. According to state law, the increased minimum wage rates become effective 15 days from this notification, which will be October 16.

Healthcare employers who are covered by this law should finalize their plans to implement necessary wage increases effective on October 16. If you’re uncertain whether the increased wages apply to your business, we recommend seeking attorney guidance in order to make a confident decision.

The new presidential administration has already made significant changes to how the Federal government approaches immigration policy. Experts suggest that employers should be prepared for a surge in I-9 audits. During the first Trump administration, audits rose from over 1,300 in 2017 to almost 6,000 in 2018 and almost 6,500 in 2019. (The COVID-19 pandemic halted a planned 15,000 audits in 2020).

The new presidential administration has already made significant changes to how the Federal government approaches immigration policy. Experts suggest that employers should be prepared for a surge in I-9 audits. During the first Trump administration, audits rose from over 1,300 in 2017 to almost 6,000 in 2018 and almost 6,500 in 2019. (The COVID-19 pandemic halted a planned 15,000 audits in 2020).

It’s hard to believe that 2025 is just around the corner! The year ahead will bring a variety of changes to California employment laws, impacting your HR policies and company procedures. We know it’s challenging to keep up with all of the new requirements while staying focused on your business, and Sierra HR is here to help! Below is a summary of key legislative changes and action steps you can take to ensure your company remains compliant and well-prepared.

It’s hard to believe that 2025 is just around the corner! The year ahead will bring a variety of changes to California employment laws, impacting your HR policies and company procedures. We know it’s challenging to keep up with all of the new requirements while staying focused on your business, and Sierra HR is here to help! Below is a summary of key legislative changes and action steps you can take to ensure your company remains compliant and well-prepared.