03.24.17

March 2017 HR Bulletin

HR Bulletin

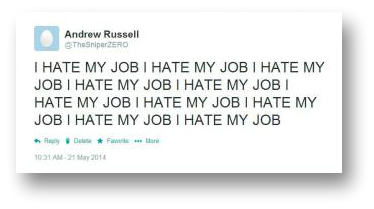

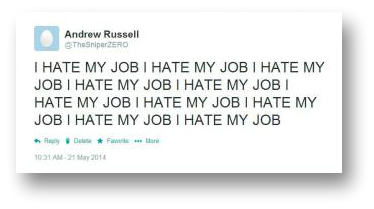

What are your employees saying about you?

If you are still using a physical suggestion box in your workplace, you may want to consider throwing it in the trash. Gone are the days when employees come to talk to you in person about their concerns or take advantage of an office suggestion box. Today, applicants and employees go online to read about a company’s culture, pay and benefits and to post about their personal experience. Do you know what is being said online about your company?

According to an article in February 2017 SHRM magazine, Glassdoor’s CEO Robert Hohman reports that 72 percent of workers say they are “OK” or “satisfied” with their jobs and companies. And the average CEO rating is 67 percent.

Employers are scrambling to figure out how to manage their online presence. Did you know that if a current or former employee posts something on Glassdoor that isn’t true that it won’t be taken down? In fact, this popular website will only consider removing posts if a non-management employee is named or profanity is used. Other than that, what is posted by a disgruntled employee stays online indefinitely.

From an HR viewpoint, we recommend you start by doing the following:

• Type your company name in the search bar and see what you find. You may see posts on several popular social media sites that should be read and addressed.

• If you find that negative comments are being made, first stop and reflect as to why. Perhaps you are experiencing a cultural shift in leadership, downsizing, merging companies or rapidly expanding.

• Posts regarding missed meal periods, long hours, safety issues or harassing behavior cannot be ignored. Conduct an immediate investigation to ensure that all workplace laws are being followed. If you find there are practices out of compliance, contact your employment counsel right away for legal guidance.

• Devise a strategy for responding to applicant and employee comments. In most cases not responding at all isn’t recommended. Will that be the owner, CEO or HR? Then decide how you plan to respond. Your responses should be authentic, fair and forthright.

• When responding, do your best to put yourself in the commenter’s shoes. Whether or not there is truth to the anonymous posts, there is some level of dissatisfaction taking place in the organization and you need to understand why.

• Create online alerts with various sites such as Glassdoor, Twitter and Facebook to automatically email you when your company is named in a post so that you remain informed.

• Encourage (but don’t require) your happy employees to post online about their experience to create a balanced picture of what it is really like to work for you.

• Take advantage of free employer branding accounts on sites like Glassdoor where you can tell the full (exciting) story of your workplace, including pay, work-life balance, benefits, culture, growth opportunities, photos, etc.

Our HR consultants are available to discuss the importance of establishing and maintaining your online employer brand.

Want to read the full newsletter? Become an HR Business Partner and receive our monthly updates by email.

As an HR Business Partner, you receive:

• Unlimited phone consultation by certified HR consultants Monday through Friday, 8 a.m. – 5:30 p.m.

• Free monthly legal seminars for designated representative

• Breaking employment news & best practices

• Discounted project rates

• Peace of mind

03.16.17

Thank you for participating in the Dress for Success Clothing Drive!

Announcements

Thank you for participating in the Dress for Success Clothing Drive!

Dress for Success’ vision is a world where women do not live in poverty. They strive for a world where all women are financially independent, are treated with dignity and respect and are directly impacting their lives and those of their families. Dress for Success aspires to create a world that fully harnesses the power of women and recognizes their role in economic sustainability.

Dress for Success’ purpose is to offer long-lasting solutions that enable women to break the cycle of poverty. Dress for Success is part of a global movement for change, empowering women to obtain safer and better futures.

They provide each client with professional attire to secure employment, but are about much more than simply a new outfit. Besides physically equipping the client with apparel and accessories, their programs furnish her with a confidence that she carries forever and the knowledge that she can actively define her life, the direction she takes and what success means to her.

Dress for Success believes that every woman has the right to realize her full potential and achieve financial independence in a more egalitarian world. They believe that with the proper education, tools and action this world is possible.

Poverty often affects women the most, and its effects on them and their families can be long-lasting. Therefore, addressing women’s needs is central to improving the quality of life for not only that woman but also her family, future generations and her community. In fact, recognizing the significant role of women in economic development is the smart thing to do, as well as being socially and morally right.

Dress for Success believes that achieving gender equality is imperative to developing a sustainable and just world for all, which is possible by acknowledging the crucial role that women play in the world economy. They believe that by building up a woman’s agency and knowledge, better synergies between gender equality and economic sustainability are realized, enabling her to generate a long-term impact in both her private and public life.

Dress for Success in an international not-for-profit organization that empowers women to achieve economic independence by providing a network of support, professional attire and the development tools to help women thrive in work and in life.

Missed out on the donation deadline?

Visit Dress for Success Fresno’s website for more information about what you can do to help!

01.16.17

New Year, New Rules

HR Bulletin

2017 Important Human Resources Updates for 2017

Happy New Year from all of us at Sierra HR Partners! As we move into the year ahead, it will be important to be aware of several human resources updates that become effective this month:

• California’s minimum wage for employers of 26 or more employees increased to $10.50 per hour. (Employers of 25 or fewer have a one-year grace period before they must begin paying higher hourly rates.) This change also affects the minimum amount you must pay an exempt employee to meet the salary test of two times the minimum wage. Exempt salaried employees must earn $43,680 per year.

• The IRS standard rate for mileage reimbursement has been decreased to 53.5 cents per mile (down from 54 cents per mile in 2016.)

• Assembly Bill 1847 requires that employers inform employees they may be eligible for the California Earned Income Tax Credit within one week before or after, or at the same time the employer provides an annual wage summary (such as a W-2 or 1099 form.) The language of the notice can be found in the Bill text. (Scroll all the way to the bottom of the web page.)

• The City of Los Angeles has passed a “Ban the Box” ordinance limiting the use of criminal history information for employers of ten or more employees, effective January 22, 2017. Job applications cannot request information about criminal histories, and the employer is prohibited from inquiring about an applicant’s criminal history until after an employment offer has been made. The ordinance also imposes a posting requirement for covered employers.

• Effective March 1, 2017, all single-user toilet facilities in any business establishment must be identified as “all gender” facilities.

Want to read the full newsletter? Become an HR Business Partner and receive our monthly updates by email.

As an HR Business Partner, you receive:

• Unlimited phone consultation by certified HR consultants Monday through Friday, 8 a.m. – 5:30 p.m.

• Free monthly legal seminars for designated representative

• Breaking employment news & best practices

• Discounted project rates

• Peace of mind

12.05.16

‘Tis the Season! Minimizing Risk During Holiday Celebrations

HR Bulletin

If you’re an HR professional, you know that while holiday parties can be fun occasions to get away from normal work formalities, they also bring concerns about alcohol consumption, inappropriate behavior, and even wage & hour procedures. (Bah humbug!)

Sierra HR Partners is here to help with this handy list of HR Best Practices for planning your office parties:

• Employees’ time for party planning, set-up, or tear-down is generally considered compensable because it benefits the employer. Be sure your party committee accurately tracks their work hours, and provide clear guidelines for when they will be considered “off-the-clock” at the event.

• Reduce expectations to pay employees for attending a holiday party by clearly communicating that attendance is voluntary, holding the event at an off-site location, and minimizing business activities such as goal setting or review of the year’s accomplishments.

• Consider no alcohol, a cash bar, or drink tickets to limit alcohol consumption. Make arrangements for sober transportation such as taxis, Uber, or designated drivers.

• Remind all employees and managers about appropriate conduct, anti-harassment policies and social media policies. Maintain your awareness, and enlist the help of other managers, to identify and address problematic issues quickly.

• In the event of an accident or injury, follow normal workers’ compensation claim procedures.

• Promptly investigate any complaints of harassment or inappropriate behavior by interviewing witnesses and taking appropriate disciplinary action.

• But go ahead and enjoy yourself! You’ve worked hard all year and you deserve that glass of champagne or extra cookie, right? (Just be sure to drink responsibly…be on your best behavior…don’t post about it on Facebook…monitor the dress code, and oh…are you clocked in for all of this?)

Want to read the full newsletter? Become an HR Business Partner and receive our monthly updates by email.

Our team of certified and experienced HR professionals are available to support you with legal compliance, training, recruitment, handbooks, audits, policies, background investigations, leaves of absence, performance evaluations, compensation, terminations, on-site HR management & related areas.

As an HR Business Partner, you receive:

- Unlimited phone consultation by certified HR consultants Monday through Friday, 8 a.m. – 5:30 p.m.

- Free monthly legal seminars for designated representative

- Breaking employment news & best practices

- Discounted project rates

- Peace of mind

11.28.16

Breaking News: Federal Overtime Rule Blocked

HR NEWS

Breaking News: Federal Overtime Rule Blocked

For the past several months, California employers have faced tough decisions regarding their exempt salaried employees and how to comply with the revised minimum salary test for exempt classification under the Fair Labor Standards Act (FLSA). This change was expected to become effective on December 1, 2016, but yesterday a federal court in Texas issued a nationwide injunction on the implementation of the new rule.

In October, a group of states filed a lawsuit claiming that the Department of  Labor exceeded its authority in enforcing a change to the federal salary test for exempt classification. The Texas court agreed, and issued a preliminary order to stop the rule while litigation continues. The court also stated that the merits of the case showed “a likelihood of success.”

Labor exceeded its authority in enforcing a change to the federal salary test for exempt classification. The Texas court agreed, and issued a preliminary order to stop the rule while litigation continues. The court also stated that the merits of the case showed “a likelihood of success.”

This means that the federal salary test for an employee to be classified under the Executive, Administrative, or Professional exemptions will remain at $455 per week instead of rising to $913. (An employee still must meet the duties test for these classifications.) California employers are required to comply with state law, which requires weekly compensation of at least two times the minimum wage to meet the salary test. The current minimum wage is $10 per hour, making the minimum salary for exempt employees $41,600 annually. On January 1, 2017, the minimum wage for employers of 26 or more employees rises to $10.50, resulting in an annual salary threshold of $43,680 for employers of 26 or more. For smaller businesses the annual salary threshold remains at $41,600 for the next year.

We know that many employers have already made significant changes to their compensation structures in an effort to maintain compliance with the federal rule. If you have questions about how to respond to this development, please contact us. Our certified Consultants will gladly assist you in understanding your options.

Labor exceeded its authority in enforcing a change to the federal salary test for exempt classification. The Texas court agreed, and issued a preliminary order to stop the rule while litigation continues. The court also stated that the merits of the case showed “a likelihood of success.”

Labor exceeded its authority in enforcing a change to the federal salary test for exempt classification. The Texas court agreed, and issued a preliminary order to stop the rule while litigation continues. The court also stated that the merits of the case showed “a likelihood of success.”