01.18.24

Withdrawing a Job Offer After a Background Investigation: Completing Individual Assessments

HR NEWS

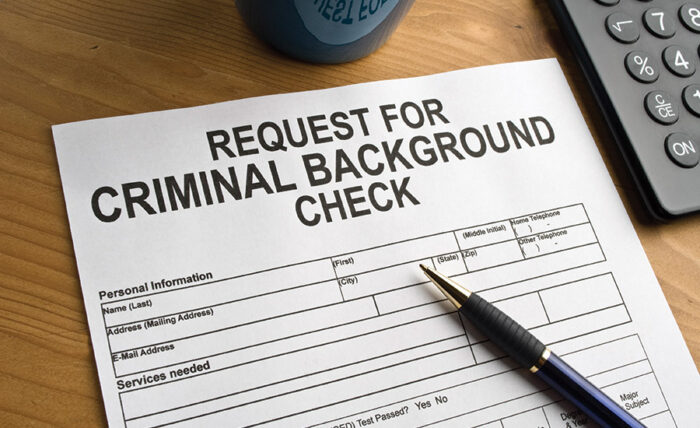

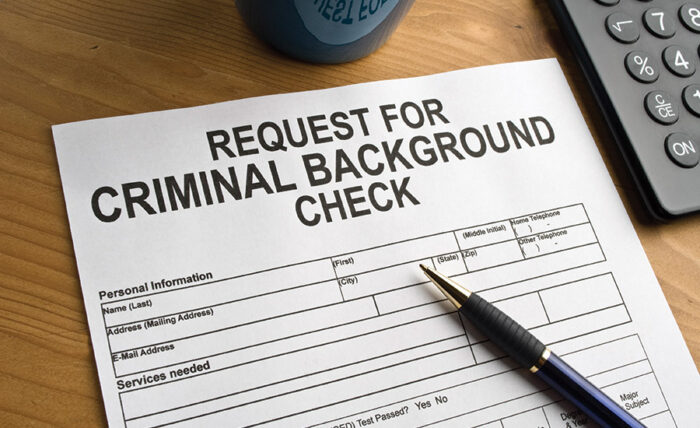

As a valued Sierra HR client, we want to be sure you are aware of the October 2023 amendments to the Fair Employment and Housing Act (FEHA) regulations, and how these changes impact an employers’ utilization of information about criminal history in employment decisions. These changes, as outlined in California Code of Regulations Title 2, Section 11017.1, introduced additional procedures that should be carefully followed by California employers when considering criminal history in decisions related to job applicants, or existing employees.

As a valued Sierra HR client, we want to be sure you are aware of the October 2023 amendments to the Fair Employment and Housing Act (FEHA) regulations, and how these changes impact an employers’ utilization of information about criminal history in employment decisions. These changes, as outlined in California Code of Regulations Title 2, Section 11017.1, introduced additional procedures that should be carefully followed by California employers when considering criminal history in decisions related to job applicants, or existing employees.

One specific area of concern is the need to complete an Individual Assessment, before an employer decides to deny an applicant the employment position he/she was conditionally offered, based on conviction history.

The employer should consider any evidence of mitigating circumstances submitted by the applicant, including:

- The personal conduct of the applicant

- Whether there was harm to property or people

- Degree of harm

- Permanence of harm

- Context of the offense

- Whether a disability (including substance impairment) contributed

- Whether the likelihood of harm could be eliminated by reasonable accommodation

- Whether the disability has been eliminated

- Whether trauma, domestic abuse, stalking, or similar factors contributed to the conduct

- The age of the applicant

- The time that passed since incarceration

- Specific job duties

- Whether the context resulting in conviction is likely to arise in the workplace

- Whether the type of harm is likely to occur in the workplace.

Additionally, final decisions to rescind an offer should be communicated in writing, including information on available procedures to challenge the decision and the right to file a complaint with the California Civil Rights Department.

Sounds complicated, right?

Our role at Sierra HR Partners is to guide you through this process. To simplify matters, we have created an Individualized Assessment form. This form is designed to provide you with a step-by-step guide in complying with new California legislation when deciding to withdraw a job offer based on background check findings.

Contact Sierra HR Partners for a copy of our Individualized Assessment Form or to learn more about our Background Investigations.

backgrounds@sierrahr.com – 559.431.8090

01.04.24

Important Reminder! California’s Paid Sick Leave requirements must go into effect this pay period!

Announcements

Senate bill 616 went into affect on January 1, 2024. All employees who work in California for 30 or more days are officially entitled to at least 5 days or 40 hours of paid sick leave annually.

If you award paid sick leave as a one-time front load each year, you will need to increase the annual amount to 5 days or 40 hours. Unused sick leave may still expire at the end of each year, and current employees must receive no less than 40 hours or 5 days at the start of the new year.

Accrual: One Hour of PSL for Every 30 Hours Worked

If your employees accrue paid sick leave at this rate, which is the default method described in the law, you may continue to do so. Unused sick leave must carry over from one year to the next, and employees must now be permitted to accrue up to 80 hours or 10 days of paid sick leave. You may limit the annual usage to 40 hours or 5 days per year.

Accrual: Other Accrual Methods/Rates

If your employees accrue PSL at a different rate, such as a certain amount per pay period or per month, you may need to adjust your policy. Employers must ensure that employees accrue at least 24 hours by the 120th day of the year, and at least 40 hours by the 200th day of the year. Employees who accrue the new maximum of 5 days over the entire year will not meet these deadlines. As stated above, unused sick leave must carry over from one year to the next, and employees must now be permitted to accrue up to 80 hours or 10 days of paid sick leave. You may limit the annual usage to 40 hours or 5 days per year.

Cities/Counties with Special Sick Leave Ordinances

If your company is located in a municipality with its own paid sick leave law, such as Los Angeles or San Francisco, local and state rules will both apply, with employers needing to comply with the most generous law. A business in Los Angeles might need to increase its accrual cap but could leave it’s usage cap the same at 48 hours.

If your company is located in a municipality with its own paid sick leave law, such as Los Angeles or San Francisco, local and state rules will both apply, with employers needing to comply with the most generous law. A business in Los Angeles might need to increase its accrual cap but could leave it’s usage cap the same at 48 hours.

We know that keeping up with these legislative changes can be challenging, but remember you’re not alone! Sierra HR Partners is here to help you navigate the ever-changing landscape of California regulations. Please contact one our team of certified consultants if you have any questions!

consultants@sierrahr.com

559.431.8090

www.sierrahr.com

10.06.23

HR Headliner: California Increases Paid Sick Leave Requirements

HR Headliner

October 2023

California Increases Paid Sick Leave Requirements

Last month, we let you know about Senate Bill 616, which was pending Governor Newsom’s signature to increase the amount of state-mandated paid sick leave from 3 days to 5 days. We didn’t have to wait long for the final outcome… the Governor signed the bill into law on October 4, 2023. Effective January 2024, all employees who work in California for 30 or more days will be entitled to at least 5 days or 40 hours of paid sick leave annually.

Last month, we let you know about Senate Bill 616, which was pending Governor Newsom’s signature to increase the amount of state-mandated paid sick leave from 3 days to 5 days. We didn’t have to wait long for the final outcome… the Governor signed the bill into law on October 4, 2023. Effective January 2024, all employees who work in California for 30 or more days will be entitled to at least 5 days or 40 hours of paid sick leave annually.

Most of our existing rules for paid sick leave remain the same, including the qualifying reasons for using sick leave, defined family members, and employee protection from retaliation. Your company’s approach to the increased amount of annual leave will depend on the method by which you provide sick leave to your staff.

Annual Front-Load

If you award paid sick leave as a one-time front load each year, you will need to increase the annual amount to 5 days or 40 hours. Remember that we interpret this requirement to be most generous to the employee, so even a part-timer who works 4-hour days must receive 40 hours of sick leave per year. An employee who normally works 10-hour days must receive 50 hours (5 days).

An interesting part of the revised law states that new employees must have at least 24 hours or 3 days available to use by the completion of the employee’s 120th calendar day of employment, and at least 40 hours or 5 days by the 200th day of employment. This means an employer could write its paid sick leave policy to provide just 24 hours of sick leave to new employees who are hired in the last 4 months of the year, or stagger the sick leave award (24 hours upon hire and an additional 16 hours within 6 months).

Unused sick leave may still expire at the end of each year, and current employees must receive no less than 40 hours or 5 days at the start of the new year.

Accrual: One Hour of PSL for Every 30 Hours Worked

If your employees accrue paid sick leave at this rate, which is the default method described in the law, you may continue to do so. Unused sick leave must carry over from one year to the next, and employees must now be permitted to accrue up to 80 hours or 10 days of paid sick leave. You may limit the annual usage to 40 hours or 5 days per year.

Accrual: Other Accrual Methods/Rates

If your employees accrue PSL at a different rate, such as a certain amount per pay period or per month, you may need to adjust your policy. Employers must ensure that employees accrue at least 24 hours by the 120th day of the year, and at least 40 hours by the 200th day of the year. As stated above, unused sick leave must carry over from one year to the next, and employees must now be permitted to accrue up to 80 hours or 10 days of paid sick leave. You may limit the annual usage to 40 hours or 5 days per year.

Cities/Counties with Special Sick Leave Ordinances

If your company is located in a municipality with its own paid sick leave law, such as Los Angeles or San Francisco, the local rules will still apply, provided they are at least as generous as the new state law.

09.06.23

September 2023: Updates In California Background Investigation Procedures

HR Headliner

September 2023

Updates In California Background Investigation Procedures

In 2017, the California legislature passed the Fair Chance Act (Assembly Bill 1008), which prohibits employers from seeking information about a job applicant’s criminal conviction history until after a conditional job offer has been extended. Employers are permitted to revoke the offer if, after an individualized assessment, the applicant’s conviction history is found to have an adverse impact on the job in question.

In 2017, the California legislature passed the Fair Chance Act (Assembly Bill 1008), which prohibits employers from seeking information about a job applicant’s criminal conviction history until after a conditional job offer has been extended. Employers are permitted to revoke the offer if, after an individualized assessment, the applicant’s conviction history is found to have an adverse impact on the job in question.

In July 2023, the California Office of Administrative Law approved an amendment to the law, which adds greater detail to employers’ existing obligations. The basic steps of the hiring and background check process remain the same, but with a higher expectation for analysis and newly defined timelines for applicant notification. The changes become effective on October 1.

Pre-Offer Screening

The amended Fair Chance Act makes clear that employers are prohibited from inquiring into an applicant’s criminal history through application forms, background checks, or internet searches prior to making a conditional job offer. Employers also cannot attempt to pre-screen applicants by including qualifications in job announcements such as “Must have a clean record,” or “No felons.” Further, the amendments state that if an employer violates the prohibitions by asking about an applicant’s criminal conviction history prior to extending a job offer, the company may not use an applicant’s failure to disclose a conviction as a factor in any subsequent hiring decisions. This means, if you ask a candidate, “Do you think you’ll pass our background check?” and the applicant says he/she probably will, you cannot withhold a job offer just because the background check shows multiple charges that the applicant neglected to mention.

Initial Individualized Assessment

Current state law requires employers to analyze an applicant’s criminal conviction history to determine whether it justifies denying the applicant the position. We are instructed to consider the nature and gravity of the offense, the time that has passed since the offense occurred, and the nature of the job being sought. The amended law requires a reasoned, evidence-based determination and provides specific examples of factors to be considered. The California Civil Rights Department (CRD) provides a sample assessment form that may be used for this analysis.

Preliminary Notice and Applicant Response

Under current law, if an employer intends to revoke a job offer based solely or in part on the applicant’s criminal conviction history, we must notify the applicant of the preliminary decision and give him/her five business days to respond with additional information disputing the background check report or sharing information about rehabilitation or other mitigating circumstances. The amended law provides several specific examples of the evidence an applicant may provide and clarifies the minimum deadline for response as five business days from the receipt of notice. If notice has been sent through e-mail, it shall be deemed received two business days after it is sent. If notice is sent through postal mail, it is deemed received five calendar days after sending to California addresses, and ten calendar days after sending to non-California addresses. The CRD provides a sample Preliminary Decision Notice, available in both English and Spanish.

Reassessment and Final Decision

Employers are required to consider any information provided by the applicant before making a final decision regarding whether or not to revoke the job offer. While the legal requirements have not changed, the amended law provides examples of factors an employer may consider such as any community service, volunteer work, or educational efforts that may demonstrate rehabilitation and suitability for the job.

If the decision to revoke the offer remains final, the applicant must be notified in writing. The notice must include a statement that the applicant may contest the decision by filing a complaint with the Civil Rights Department. The CRD provides a sample Final Notice, available in both English and Spanish.

As always, Sierra HR Partners is here to help you navigate the ever-changing landscape of California regulations. Please contact us with any questions you have about your background investigation procedures and applicant notifications.

08.22.23

California’s Shifting Minimum Wage

HR Headliner

Recent History

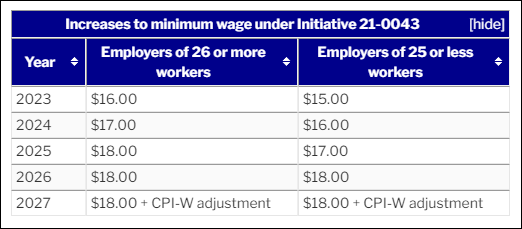

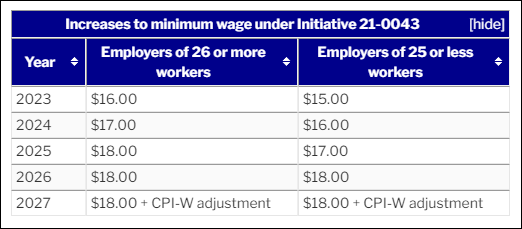

California has had an especially dynamic minimum wage for several years. Senate Bill 3, passed in 2016, began a series of required annual increases at the start of each new calendar year. We have watched the minimum wage rate rise from $10.00 in 2016 to $15.00 per hour in 2022. Employers who adjusted payroll budgets every January looked forward to wage stability after that period of increases. Unfortunately, we have the opposite.

The same Senate Bill also added a provision to the Labor Code that requires the state Director of Finance to increase the minimum wage based on inflation. These increases must be determined “on or before August 1.” This is the provision behind the minimum wage increase to $15.50 for all employers effective January 1, 2023.

$16 Per Hour in 2024

Now, in a memo to Governor Newsom and other state leaders dated July 31, 2023, the state Director of Finance has announced that a similar minimum wage increase will be happening January 1, 2024. All employers, regardless of size, will be required to pay at least $16.00 per hour. This will not only impact those earning minimum wage, but also exempt employees who must earn at least twice the state minimum wage. Starting January 1, 2024, exempt employees must make at least $66,560 per year.

2024 Ballot Measure

While planning for the upcoming calendar year, employers should also take note of a 2024 ballot measure that proposes increasing the minimum wage to $18.00 per hour by 2026, with further hikes based on the Consumer Price Index.

Next Steps

For now, all employers should plan for the increase in minimum wage to $16.00 per hour and the associated changes (e.g., salaries for exempt employees and wages for employees required to use their own tools). We should expect additional announcements about the minimum wage for computer professionals later this year, and if you live in a municipality that has historically raised minimum wages above the state minimum (an early 2023 city ordinance in the city of Los Angeles raised the minimum wage there to $16.78 effective July 1, for example) we recommend keeping a close eye out for additional adjustments.

As always, Sierra HR Partners is here to help you navigate the ever-changing landscape of California regulations. Please contact one of our Consultants with any questions you have.

As a valued Sierra HR client, we want to be sure you are aware of the October 2023 amendments to the Fair Employment and Housing Act (FEHA) regulations, and how these changes impact an employers’ utilization of information about criminal history in employment decisions. These changes, as outlined in California Code of Regulations Title 2, Section 11017.1, introduced additional procedures that should be carefully followed by California employers when considering criminal history in decisions related to job applicants, or existing employees.

As a valued Sierra HR client, we want to be sure you are aware of the October 2023 amendments to the Fair Employment and Housing Act (FEHA) regulations, and how these changes impact an employers’ utilization of information about criminal history in employment decisions. These changes, as outlined in California Code of Regulations Title 2, Section 11017.1, introduced additional procedures that should be carefully followed by California employers when considering criminal history in decisions related to job applicants, or existing employees.

If your company is located in a municipality with its own paid sick leave law, such as Los Angeles or San Francisco, local and state rules will both apply, with employers needing to comply with the most generous law. A business in Los Angeles might need to increase its accrual cap but could leave it’s usage cap the same at 48 hours.

If your company is located in a municipality with its own paid sick leave law, such as Los Angeles or San Francisco, local and state rules will both apply, with employers needing to comply with the most generous law. A business in Los Angeles might need to increase its accrual cap but could leave it’s usage cap the same at 48 hours.

Last month,

Last month,  In 2017, the California legislature passed the

In 2017, the California legislature passed the